On 14 November 2014, at the plenary session of the Parliament of Georgia, Minister of Finance of Georgia, Nodar Khaduri stated: “The interest rate of treasury bonds is being reduced significantly. The interest rate of one-year bonds is up to 5% as of today.”

FactCheck took interest in the changes in the interest rates of treasury bonds and verified the accuracy of Mr Khaduri’s statement.

Treasury bonds are state bonds, denominated in GEL and issued by the Ministry of Finance of Georgia, which have different terms. These bonds are sold on auctions held by the National Bank of Georgia. The participants of the auctions are Georgian commercial banks.

Domestic debt can be taken using the aforementioned treasury bonds. Based upon the official data of the Ministry of Finance of Georgia, we analysed the interest rate of the domestic debt of the country and whether or not it has reduced.

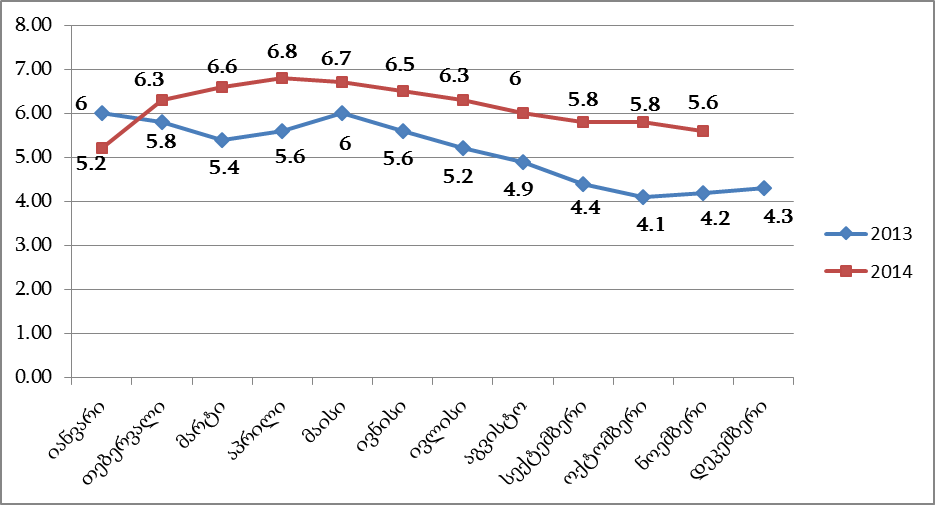

Chart 1: Average Interest Rate of Twelve-Month Treasury Bonds in 2013 and 2014

As we can see, the interest rate of the treasury bonds has been increasing from January to April 2014. However, there was a trend of reduction from May to November. The interest rate had a trend of decline in 2013 as well. The interest rates of this year are higher as compared to the previous year.

The trend of the interest rate reduction of two-year, five-year and ten-year treasury bonds has been observed from the second quarter of 2014.

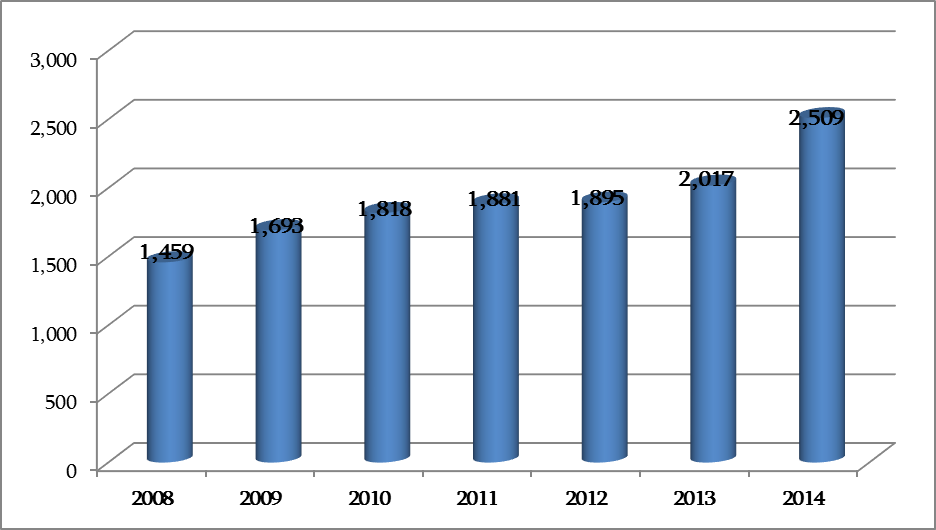

FactCheck took interest in the level of domestic debt as well. According to the data of the end of 2014, Georgia’s domestic debt amounts to GEL 2,509 million. The amount of domestic debt in treasury bonds only (without the so-called historic debt) equals GEL 1,857 million. Based upon the data of recent years, the amount of domestic debt has been increasing every year. However, the biggest rise in domestic debt was recorded in 2014.

Chart 2: State Domestic Debt (GEL Million)

Conclusion

The interest rate of twelve-month treasury bonds started to decrease after the second quarter of 2014. According to the most recent data, the interest rate varies from 5.6% to 5.8%. Despite the fact that the interest rate has reduced as compared to the other quarters of this year, it is 1.4% higher than that of the previous year. In addition, the interest rate is significantly higher than stated by the Minister (5%).

It should be noted that the domestic debt is taken using treasury and other state bonds. According to the data of recent years (2009-2014), the highest growth of the domestic debt was recorded in 2014.

FactCheck concludes that Mr Khaduri’s statement: “The interest rate of treasury bonds is being reduced significantly. The interest rate of one-year bonds is up to 5% as of today,” is HALF TRUE.

“The interest rate of one-year treasury bonds is up to 5% as of today.”

02/12/2014

Half True

The statement is partly accurate, but the details are missing or some of the issues are without context