On 11 December 2013, the Parliament discussed the 2014 state budget of Georgia. At the session, Member of the Parliamentary Majority, Guguli Maghradze, stated that 7% of the state budget was earmarked for the funding of the Ministry of Education and Science which she evaluated as a fairly good indicator. This remark by the MP was commented upon by the Minister of Finance, Nodar Khaduri, who stated: “We allocate 7% of our budget for science and education. A restriction is placed upon us by the Georgian Constitution in this regard according to which we are not allowed to raise taxes, nor are we planning to do so. Therefore, we are constrained in terms of expenditures as well. Pursuant to the Constitution, state budget expenditures are not to exceed 30% of the GDP.”

FactCheck verified the accuracy of the statement voiced by the Minister of Finance.

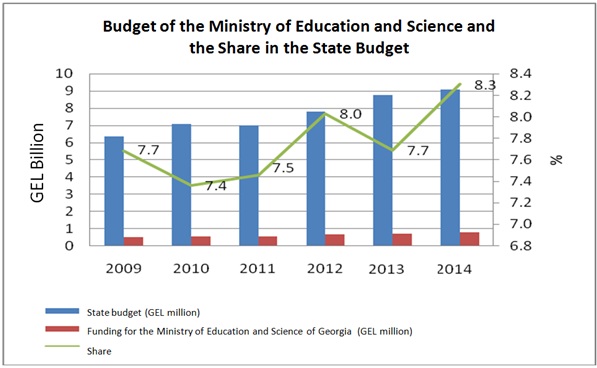

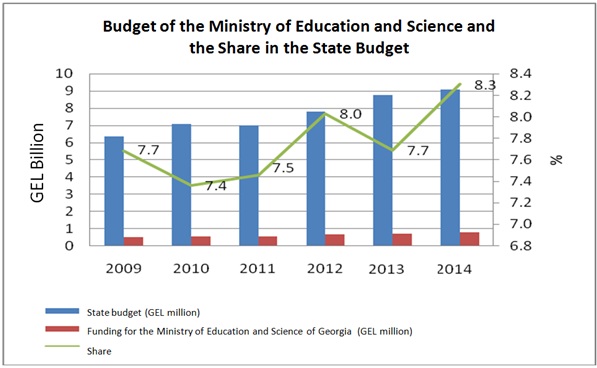

The 2014 state budget of Georgia totals GEL 9,105.0 million. The funding earmarked for the Ministry of Education and Science amounts to GEL 754.3 million which comprises 8% of the state budget. The funding provided for the Ministry of Education and Science in 2014 exceeded the amount allotted in 2013 by GEL 84.3 million.

The graph below presents the data on the funding of the Ministry of Education and Science over the past years.

As can be seen in the graph, over the years 2009-2014 the funding provided to the Ministry ranged between 7-8%.

As for the introduction of new taxes, in accordance with the Georgian Constitution, only a referendum can impose a new state-wide tax (exclusive of the excise tax) or increase the established marginal tax rate (exclusive of the cases defined in the organic laws). The right of starting an initiative to hold a referendum is restricted to the Georgian Government.

In 2011, the Parliament adopted the Organic Law on Economic Freedom which entered into force on 31 December 2013. The Law further specifies the norms prescribed in Article 94 of the Constitution and provides for citizen participation in the defining of taxes. In the case if the newly imposed tax or the changed marginal rate is introduced as an alternative to the existing one and, therefore, does not increase the tax burden for citizens, this addition is not qualified as the abovedescribed introduction of a new tax or an increase of marginal rates. At the same time, in exceptional cases, Article 1 of the Law empowers the Government to demand a temporary increase of taxes for no more than three years without holding a referendum.

The Organic Law of Georgia on Economic Freedom further defines macroeconomic parameters which ensure the long-term and sustainable growth of the Georgian economy. In line with the legislation, the ratio of the consolidated budget expenditures and the growth of the non-financial assets to the state GDP are not to exceed 30% (Article 1). This parameter varies across countries and its specifications differ depending upon diverging methodologies and goals.

According to the 2014 budget forecast of Georgia, the ratio of the projected revenues of the consolidated budget to the GDP will reach 26.9% in 2014. This indicator falls within the margins of the abovegiven parameters prescribed in the Organic Law on Economic Freedom.

Conclusion

The funding earmarked for the Ministry of Education and Science in 2014 amounts to 8% of the state budget which exceeds by 1% the figure indicated in the statement of Nodar Khaduri – 7%.

After the constitutional amendments introduced in 2011, the taxes can be raised only by means of a referendum. The state is indeed constrained in terms of imposing a new tax or increasing the established margin rates. However, in the case of need, the organic law of Georgia gives an authority to the Government to raise taxes for a limited period of up to three years.

The Organic Law of Georgia on Economic Freedom defines macroeconomic parameters according to which, the ratio of the consolidated budget expenditures and the growth of the non-financial assets to the state GDP is not to exceed 30%. This finding comes in agreement with Nodar Khaduri’s statement. In line with the budgetary projections of 2014, the ratio of the consolidated budget revenues forecast for 2014 to the GDP is to reach 26.9%.

We conclude that Nodar Khaduri’s statement: “We allocate 7% of our budget for science and education. A restriction is placed upon us by the Georgian Constitution in this regard according to which we are not allowed to raise taxes, nor are we planning to do so. Therefore, we are constrained in terms of expenditures as well. Pursuant to the Constitution, state budget expenditures are not to exceed 30% of the GDP,” is TRUE.

As can be seen in the graph, over the years 2009-2014 the funding provided to the Ministry ranged between 7-8%.

As for the introduction of new taxes, in accordance with the Georgian Constitution, only a referendum can impose a new state-wide tax (exclusive of the excise tax) or increase the established marginal tax rate (exclusive of the cases defined in the organic laws). The right of starting an initiative to hold a referendum is restricted to the Georgian Government.

In 2011, the Parliament adopted the Organic Law on Economic Freedom which entered into force on 31 December 2013. The Law further specifies the norms prescribed in Article 94 of the Constitution and provides for citizen participation in the defining of taxes. In the case if the newly imposed tax or the changed marginal rate is introduced as an alternative to the existing one and, therefore, does not increase the tax burden for citizens, this addition is not qualified as the abovedescribed introduction of a new tax or an increase of marginal rates. At the same time, in exceptional cases, Article 1 of the Law empowers the Government to demand a temporary increase of taxes for no more than three years without holding a referendum.

The Organic Law of Georgia on Economic Freedom further defines macroeconomic parameters which ensure the long-term and sustainable growth of the Georgian economy. In line with the legislation, the ratio of the consolidated budget expenditures and the growth of the non-financial assets to the state GDP are not to exceed 30% (Article 1). This parameter varies across countries and its specifications differ depending upon diverging methodologies and goals.

According to the 2014 budget forecast of Georgia, the ratio of the projected revenues of the consolidated budget to the GDP will reach 26.9% in 2014. This indicator falls within the margins of the abovegiven parameters prescribed in the Organic Law on Economic Freedom.

Conclusion

The funding earmarked for the Ministry of Education and Science in 2014 amounts to 8% of the state budget which exceeds by 1% the figure indicated in the statement of Nodar Khaduri – 7%.

After the constitutional amendments introduced in 2011, the taxes can be raised only by means of a referendum. The state is indeed constrained in terms of imposing a new tax or increasing the established margin rates. However, in the case of need, the organic law of Georgia gives an authority to the Government to raise taxes for a limited period of up to three years.

The Organic Law of Georgia on Economic Freedom defines macroeconomic parameters according to which, the ratio of the consolidated budget expenditures and the growth of the non-financial assets to the state GDP is not to exceed 30%. This finding comes in agreement with Nodar Khaduri’s statement. In line with the budgetary projections of 2014, the ratio of the consolidated budget revenues forecast for 2014 to the GDP is to reach 26.9%.

We conclude that Nodar Khaduri’s statement: “We allocate 7% of our budget for science and education. A restriction is placed upon us by the Georgian Constitution in this regard according to which we are not allowed to raise taxes, nor are we planning to do so. Therefore, we are constrained in terms of expenditures as well. Pursuant to the Constitution, state budget expenditures are not to exceed 30% of the GDP,” is TRUE.

As can be seen in the graph, over the years 2009-2014 the funding provided to the Ministry ranged between 7-8%.

As for the introduction of new taxes, in accordance with the Georgian Constitution, only a referendum can impose a new state-wide tax (exclusive of the excise tax) or increase the established marginal tax rate (exclusive of the cases defined in the organic laws). The right of starting an initiative to hold a referendum is restricted to the Georgian Government.

In 2011, the Parliament adopted the Organic Law on Economic Freedom which entered into force on 31 December 2013. The Law further specifies the norms prescribed in Article 94 of the Constitution and provides for citizen participation in the defining of taxes. In the case if the newly imposed tax or the changed marginal rate is introduced as an alternative to the existing one and, therefore, does not increase the tax burden for citizens, this addition is not qualified as the abovedescribed introduction of a new tax or an increase of marginal rates. At the same time, in exceptional cases, Article 1 of the Law empowers the Government to demand a temporary increase of taxes for no more than three years without holding a referendum.

The Organic Law of Georgia on Economic Freedom further defines macroeconomic parameters which ensure the long-term and sustainable growth of the Georgian economy. In line with the legislation, the ratio of the consolidated budget expenditures and the growth of the non-financial assets to the state GDP are not to exceed 30% (Article 1). This parameter varies across countries and its specifications differ depending upon diverging methodologies and goals.

According to the 2014 budget forecast of Georgia, the ratio of the projected revenues of the consolidated budget to the GDP will reach 26.9% in 2014. This indicator falls within the margins of the abovegiven parameters prescribed in the Organic Law on Economic Freedom.

Conclusion

The funding earmarked for the Ministry of Education and Science in 2014 amounts to 8% of the state budget which exceeds by 1% the figure indicated in the statement of Nodar Khaduri – 7%.

After the constitutional amendments introduced in 2011, the taxes can be raised only by means of a referendum. The state is indeed constrained in terms of imposing a new tax or increasing the established margin rates. However, in the case of need, the organic law of Georgia gives an authority to the Government to raise taxes for a limited period of up to three years.

The Organic Law of Georgia on Economic Freedom defines macroeconomic parameters according to which, the ratio of the consolidated budget expenditures and the growth of the non-financial assets to the state GDP is not to exceed 30%. This finding comes in agreement with Nodar Khaduri’s statement. In line with the budgetary projections of 2014, the ratio of the consolidated budget revenues forecast for 2014 to the GDP is to reach 26.9%.

We conclude that Nodar Khaduri’s statement: “We allocate 7% of our budget for science and education. A restriction is placed upon us by the Georgian Constitution in this regard according to which we are not allowed to raise taxes, nor are we planning to do so. Therefore, we are constrained in terms of expenditures as well. Pursuant to the Constitution, state budget expenditures are not to exceed 30% of the GDP,” is TRUE.

As can be seen in the graph, over the years 2009-2014 the funding provided to the Ministry ranged between 7-8%.

As for the introduction of new taxes, in accordance with the Georgian Constitution, only a referendum can impose a new state-wide tax (exclusive of the excise tax) or increase the established marginal tax rate (exclusive of the cases defined in the organic laws). The right of starting an initiative to hold a referendum is restricted to the Georgian Government.

In 2011, the Parliament adopted the Organic Law on Economic Freedom which entered into force on 31 December 2013. The Law further specifies the norms prescribed in Article 94 of the Constitution and provides for citizen participation in the defining of taxes. In the case if the newly imposed tax or the changed marginal rate is introduced as an alternative to the existing one and, therefore, does not increase the tax burden for citizens, this addition is not qualified as the abovedescribed introduction of a new tax or an increase of marginal rates. At the same time, in exceptional cases, Article 1 of the Law empowers the Government to demand a temporary increase of taxes for no more than three years without holding a referendum.

The Organic Law of Georgia on Economic Freedom further defines macroeconomic parameters which ensure the long-term and sustainable growth of the Georgian economy. In line with the legislation, the ratio of the consolidated budget expenditures and the growth of the non-financial assets to the state GDP are not to exceed 30% (Article 1). This parameter varies across countries and its specifications differ depending upon diverging methodologies and goals.

According to the 2014 budget forecast of Georgia, the ratio of the projected revenues of the consolidated budget to the GDP will reach 26.9% in 2014. This indicator falls within the margins of the abovegiven parameters prescribed in the Organic Law on Economic Freedom.

Conclusion

The funding earmarked for the Ministry of Education and Science in 2014 amounts to 8% of the state budget which exceeds by 1% the figure indicated in the statement of Nodar Khaduri – 7%.

After the constitutional amendments introduced in 2011, the taxes can be raised only by means of a referendum. The state is indeed constrained in terms of imposing a new tax or increasing the established margin rates. However, in the case of need, the organic law of Georgia gives an authority to the Government to raise taxes for a limited period of up to three years.

The Organic Law of Georgia on Economic Freedom defines macroeconomic parameters according to which, the ratio of the consolidated budget expenditures and the growth of the non-financial assets to the state GDP is not to exceed 30%. This finding comes in agreement with Nodar Khaduri’s statement. In line with the budgetary projections of 2014, the ratio of the consolidated budget revenues forecast for 2014 to the GDP is to reach 26.9%.

We conclude that Nodar Khaduri’s statement: “We allocate 7% of our budget for science and education. A restriction is placed upon us by the Georgian Constitution in this regard according to which we are not allowed to raise taxes, nor are we planning to do so. Therefore, we are constrained in terms of expenditures as well. Pursuant to the Constitution, state budget expenditures are not to exceed 30% of the GDP,” is TRUE.